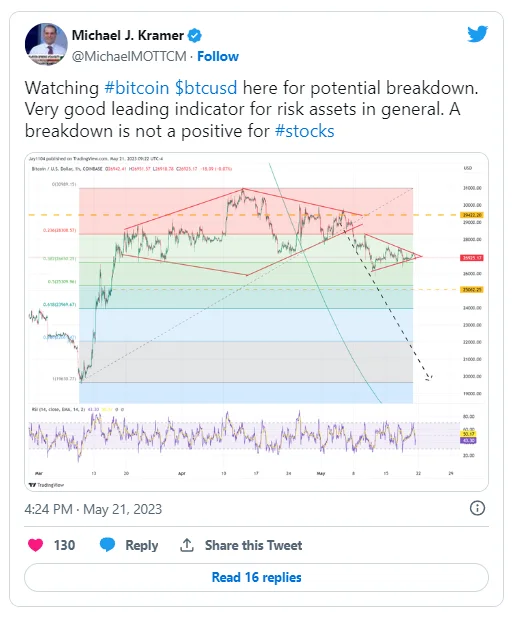

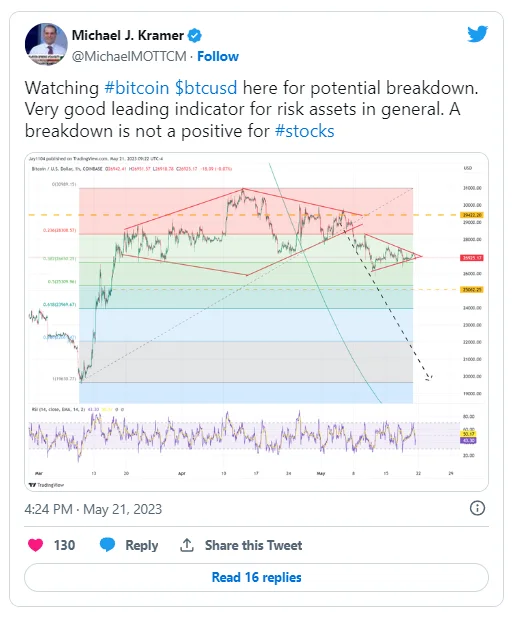

Michael Kramer, founder of the asset management company Mott Capital Management, expressed concern about the first cryptocurrency falling to near $20,000.

According to him, bitcoin is a very good leading indicator for high-risk assets in general. Therefore, the expert believes that the fall of digital gold will be a negative factor for the stock market.

At the end of April, the rate of the first cryptocurrency returned to the marks above $30,000, but did not hold on to them. At the time of writing, the price is once again trying to consolidate above the level of $27,000 for the past few days, the growth for the day was 1% (CoinGecko).

In March, industry influencers interviewed by CNBC were bullish on bitcoin. They predicted that the asset could test its previous high this year and even reach $100,000.

Ryan Selkis, the founder and CEO of the Messari analytical company, expressed confidence in the growth to this mark, but within 12 months.

Analysts at Standard Chartered gave a longer time frame for bitcoin to reach $100,000 – by the end of 2024.

Confidence that the industry will soon see that price was expressed by Robert Kiyosaki, author of the bestseller “Rich Daddy, Poor Daddy” and entrepreneur. Recall that economist and author of the iconic book “The Bitcoin Standard” Seifedin Ammus criticized a bolder prediction – $1 million per bitcoin in the short term.

Leave a Reply