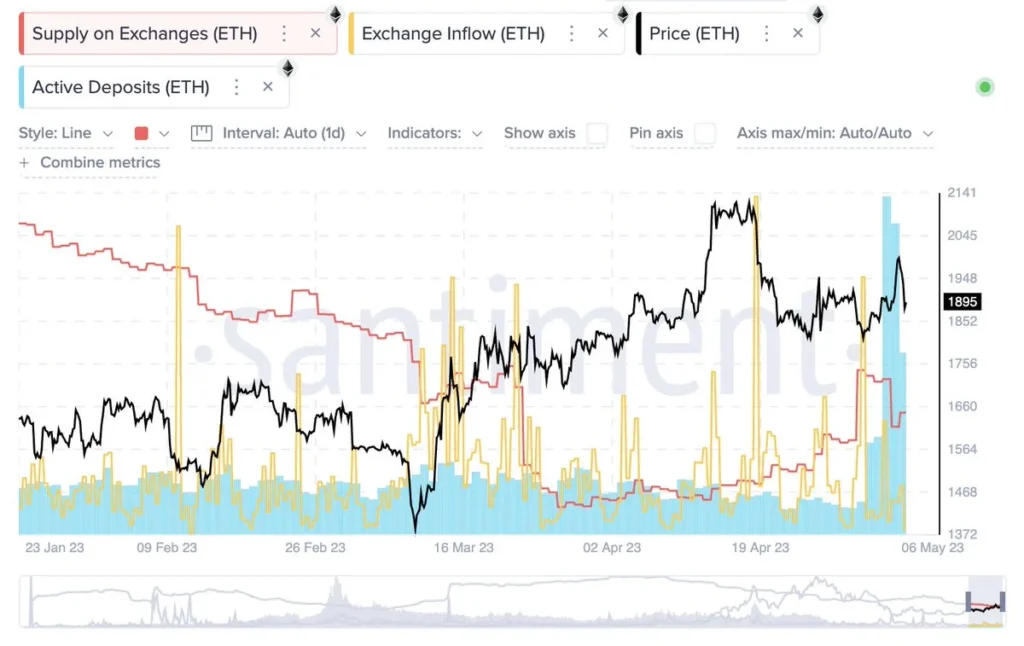

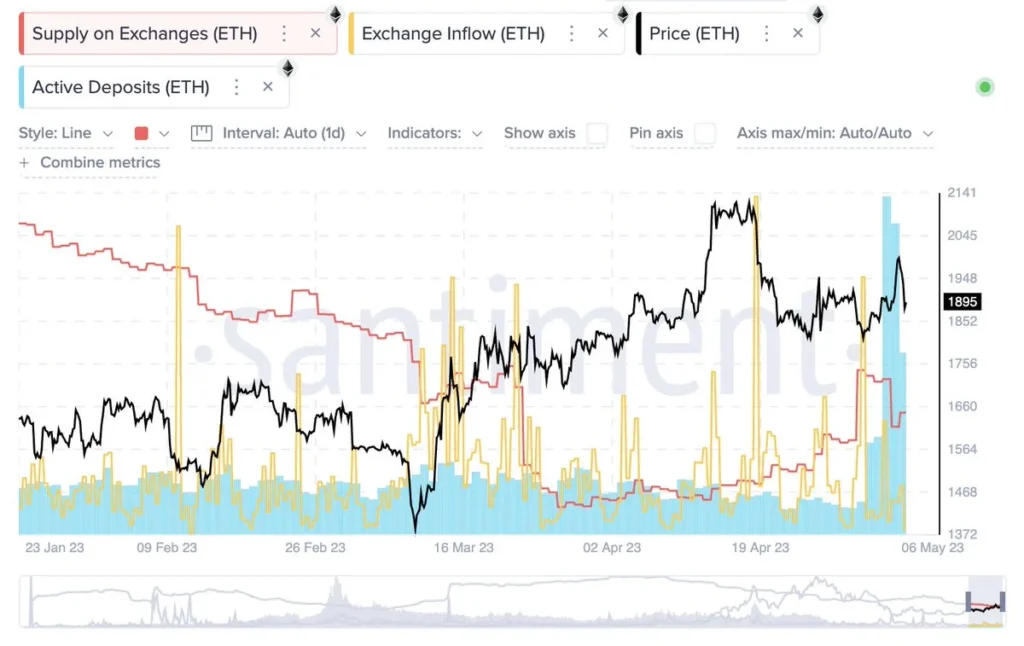

At the beginning of May, the inflow of Ethereum to exchange wallets intensified, as evidenced by data from Santiment.

The largest altcoin fell to $1840 today. The fall of ETH was preceded by a sharp increase in the supply of the cryptocurrency on trading floors.

Analysts note that the number of users sending ETH to exchanges reached the highest level since November 2021. At its peak, the number of active addresses adding to exchange reserves exceeded 20,000, according to the Santiment report. It was this factor that triggered the return of the bearish trend and the ethereum pullback below $1900.

However, experts doubt that the pressure from sellers will be long-term. Most likely, in the coming days, the outflow of ETH from exchange addresses will resume.

The reduction in the supply of the cryptocurrency available for sale will help it not only return to values above $1900, but even approach $2000.

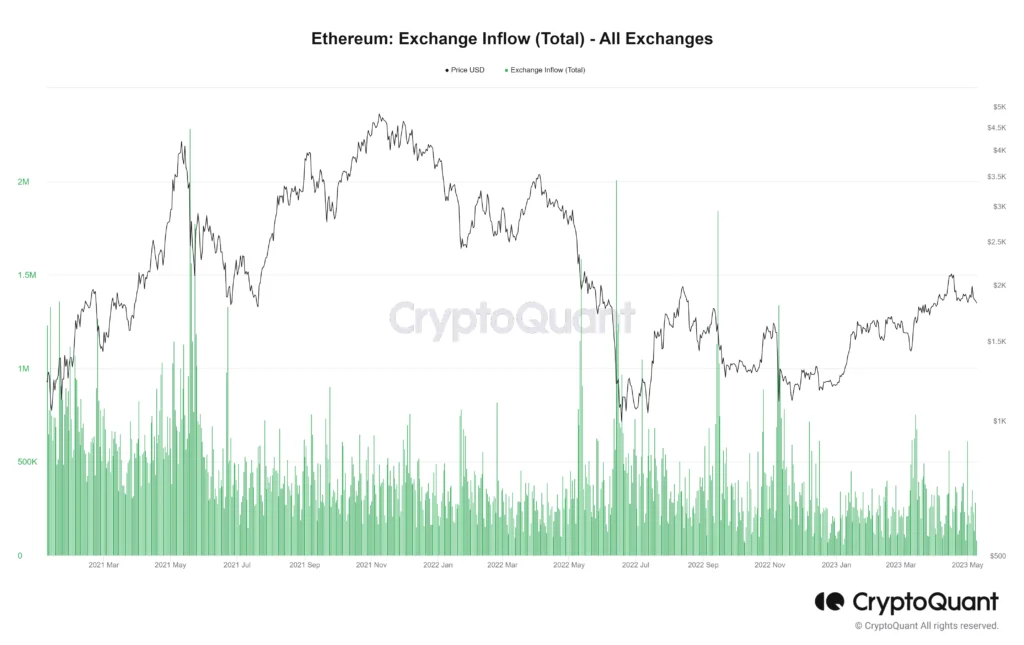

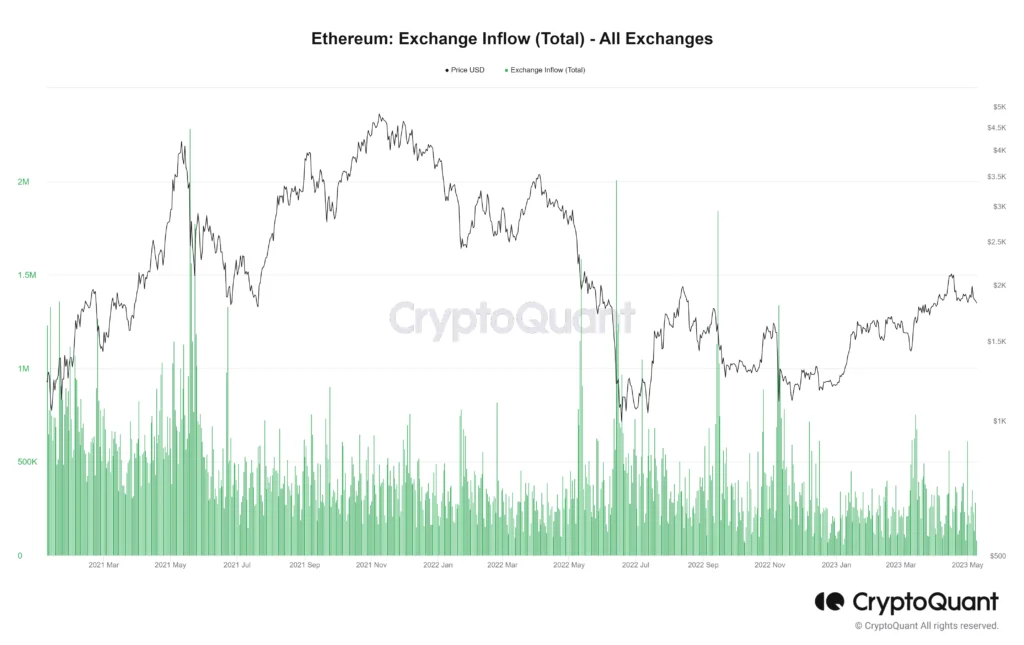

According to CryptoQuant, ether was actively entering exchange addresses in early May.

However, as early as this week, investors began to send the cryptocurrency to trading venues less frequently. The last major entry of ether to exchanges was recorded last Friday (352,620 ETH).

Well, this can’t last much longer.