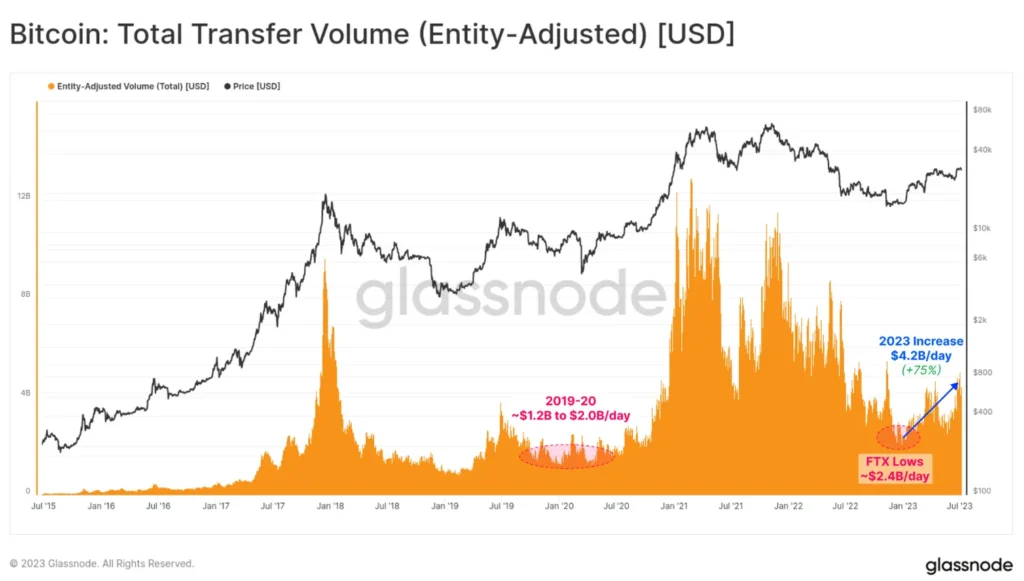

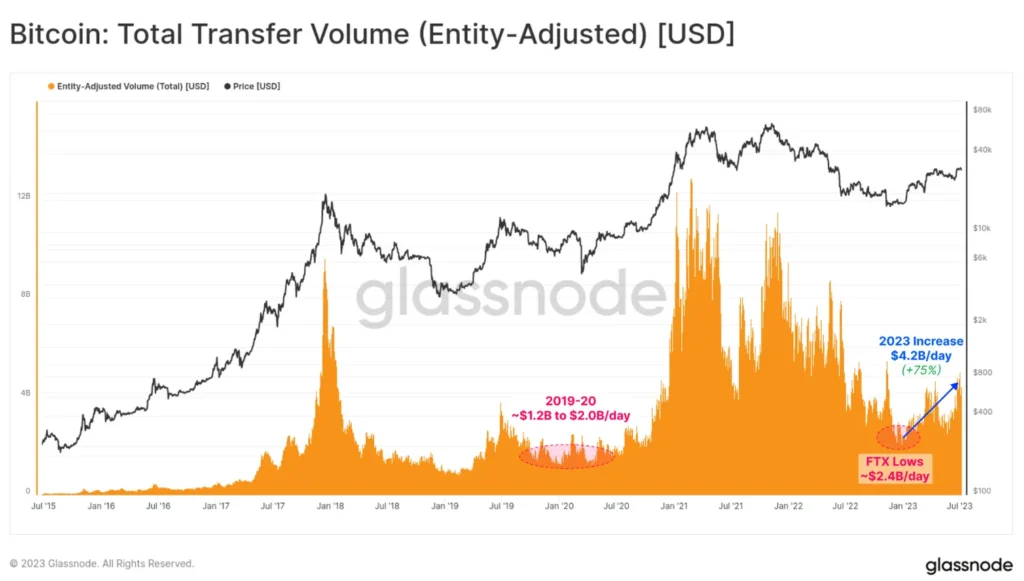

Glassnode noticed the high activity of bitcoin traders. The volume of cryptocurrency trading increased by 75% compared to the indicators observed after the collapse of the FTX exchange.

The average amount of transactions with BTC rose to $4.2 billion per day. In the fall of 2022 amid the mass flight of investors from centralized exchanges, bitcoin trading fell to $2.4 billion per day, analysts stressed. In June and July, accumulation is actively engaged in medium and large investors – sharks and whales. Addresses controlling between 10 and 10,000 bitcoins worth between $300,000 and $300 million have accumulated more than 13 million BTC in total.

The Santiment team found that these wallets started buying in mid-June. By July 8, their total reserves had grown by about 71,000 BTC. They took advantage of the cryptocurrency’s drop below $28,000 and didn’t give up the accumulation rate even when bitcoin broke above $30,000.

According to analysts, the move by medium and large investors to buy hints that the bottom has been reached.

The activity of traders is decreasing this week, as evidenced by data from the Bitinfocharts service. This leads to a reduction in the range of BTC price fluctuations. The number of transactions on the blockchain fell to 506,961 per day after soaring to nearly 600,000 in early July.

Leave a Reply